How To Add Sales Tax To Square App

Square Online Tax Settings

DISCLAIMER: Tax compliance is your responsibility. We do non guarantee the applicability or accuracy of our taxation tools. If you accept whatsoever questions about your tax obligations, you should consult a professional tax advisor.

To fix taxes for Square Online:

-

Open the Square Online Overview folio.

-

Select Shared Settings > Sales Taxes.

The revenue enhancement settings for your online shop make it easy to ready up and manage sales tax. And if you're located in the The states, we provide an automatic tax calculator to make it fifty-fifty easier.

The automated revenue enhancement figurer will accuse Us sales tax based on all store addresses yous've entered and where yous ship an order to. For example, let's say your concrete shop is in California, merely yous send orders from a location in Arizona. The automatic revenue enhancement calculator will add rates for both Arizona and California. If you sell and transport from the same location, and then yous'll only charge revenue enhancement for orders going to that state. The near of import affair to think well-nigh Us taxes is that you simply demand to collect them if you have a presence in the state that you are aircraft an club to. If you don't, you don't collect taxes.

How the Automatic Tax Calculator Works

When y'all receive an order, the automatic taxation calculator first checks to see if your store has a presence in the land you'll be shipping to. This is adamant based on the store addresses you've added:

Store address: configured on the Shared Settings > General page

Shipping accost: configured on the Fulfillment > Shipping page

Tax locations: configured on the Shared Settings > Sales Taxes page

The calculator checks each location and if yous don't have a presence in the state you're aircraft to, no taxes are charged.

Note: When a client has unlike billing and shipping addresses, only the aircraft accost matters in terms of charging tax. For orders that volition be picked up in-store or delivered to the customer, local sales tax will be added appropriately.

Particular-level Taxes

Yous can utilize the item-level tax rates in your online Square Dashboard for pickup, commitment, and self-serve orders. Shipping orders utilise the revenue enhancement rates gear up in the Square Online Overview page settings. To turn on item-level taxes:

-

Open the Square Online Overview page.

-

Select Shared Settings > Sales Taxes.

-

Under Order-level taxes, toggle on item-level taxes for pickup, commitment, self-serve or all iii.

-

Click the Get To Item Taxes button to view item-level taxes in the online Foursquare Dashboard.

Customers who received an detail-level tax rate on an order can view a adding of their taxes during checkout, displayed by tax name. If a customer selects pickup or delivery for an particular that does not have an item-level revenue enhancement rate, no revenue enhancement will be applied to the purchase. Tax exempt items in Square only utilize to Square Online pickup, delivery, or self-serve orders. Shipped orders will utilise the revenue enhancement rates set in the Foursquare Online Overview page settings.

Sales Revenue enhancement for Canada

If yous're located in and transport to Canada, the Canadian country tax charge per unit is pre-filled along with whatever additional, compound or replacement tax charged by the destination province or territory. For example, if an lodge is shipping to British Columbia, an extra 7% is added to the land's v% tax rate. You can edit and override any of the pre-set Canadian tax rates, merely they cannot be deleted.

Sales Taxation for Other Countries

For locations outside the The states and Canada, you'll demand to add the revenue enhancement rates manually.

Foursquare Online at present supports charging price inclusive taxes in the Uk, United states, and Canada. When taxes are ready to be inclusive, the price of each item sold on your site will already include the tax.

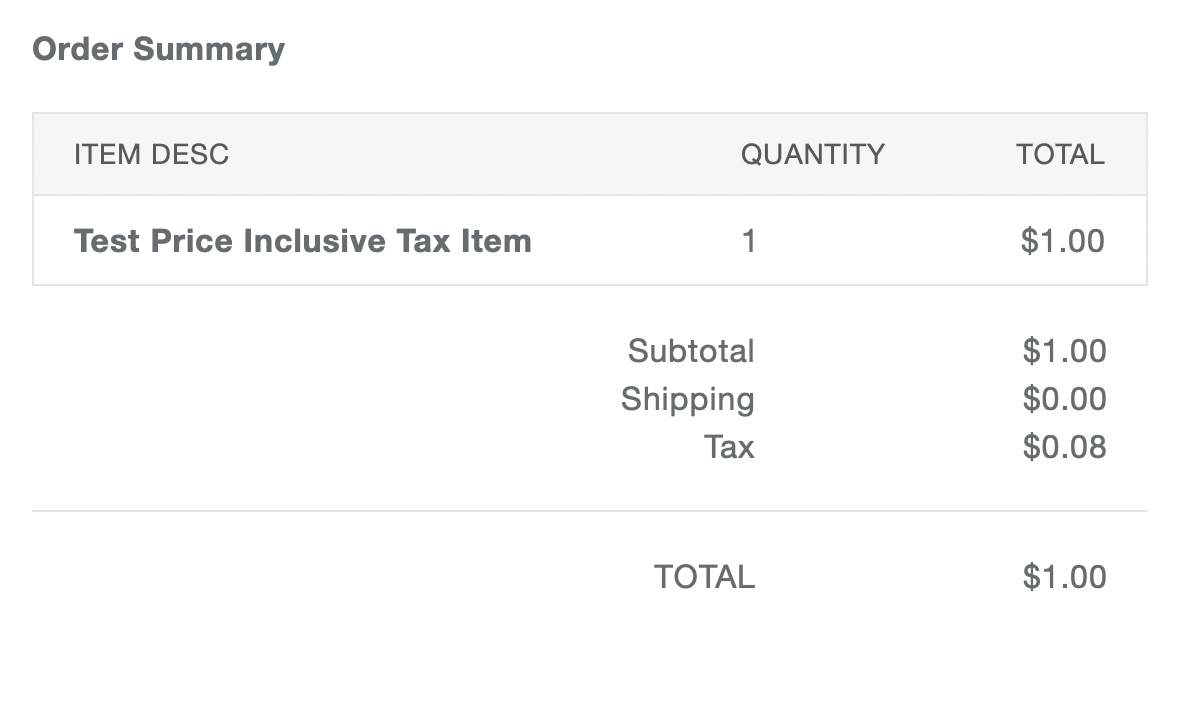

Above is an instance of what your customers will see when they purchase from a site with price inclusive taxes enabled. In this instance, the client is purchasing an particular for $1 from a seller with an 8% price inclusive value-added tax (VAT) enabled.

-

Subtotal: This line item represents the sum price of all items in the gild, and information technology includes whatsoever toll inclusive taxes

-

Revenue enhancement: This line particular breaks out the taxes from the subtotal so that the customer can run into the verbal revenue enhancement amount paid

-

Full: This line item is the full cost of the order, including the subtotal and any additional fees (such as shipping) that are practical.

Note: the divide Revenue enhancement line item is non summed as taxes are already included in the subtotal.

How To Add Sales Tax To Square App,

Source: https://squareup.com/help/us/en/article/6878-all-about-taxes-square-online-store

Posted by: sanderslawen1948.blogspot.com

0 Response to "How To Add Sales Tax To Square App"

Post a Comment